Built for family offices and HNW/UHNW clients requiring named IBAN rails, secure custody, advisor permissioning, and private-banking-grade transparency.

One KYC

One Interface

Swiss Regulated

300 Assets

Built for family offices and HNW/UHNW clients requiring named IBAN rails, secure custody, advisor permissioning, and private-banking-grade transparency.

One KYC

One Interface

Swiss Regulated

300 Assets

Built for family offices and HNW/UHNW clients requiring named IBAN rails, secure custody, advisor permissioning, and private-banking-grade transparency.

One KYC

One Interface

Swiss Regulated

300 Assets

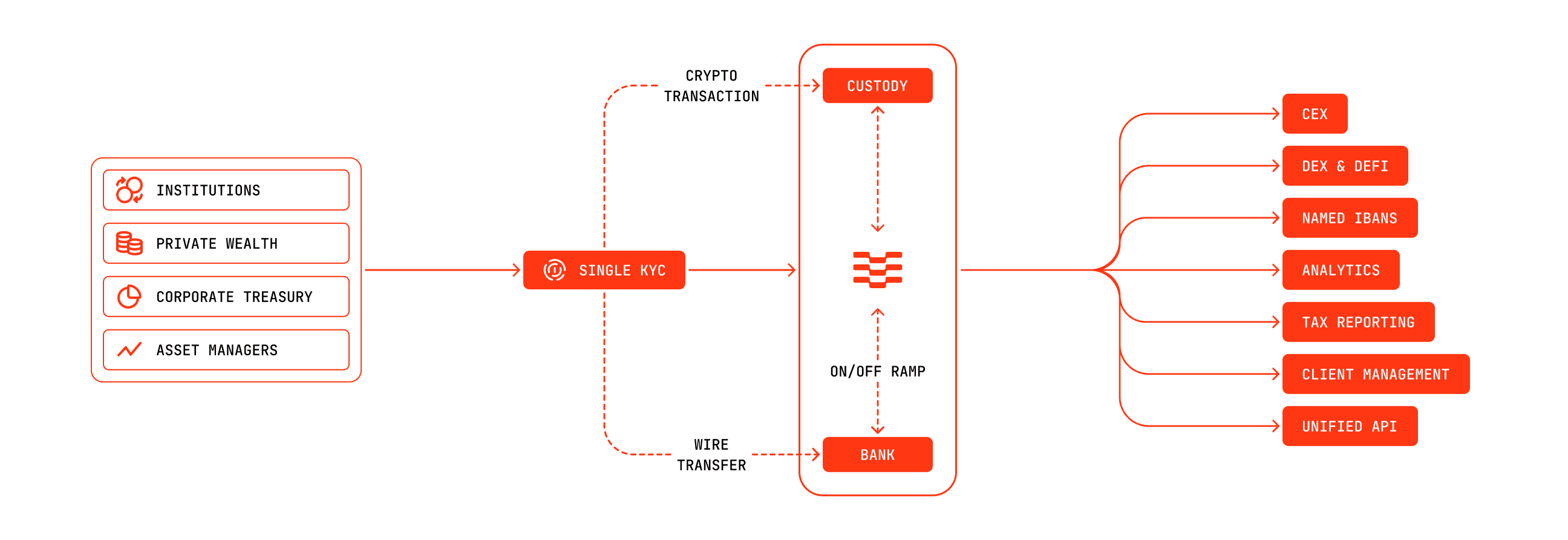

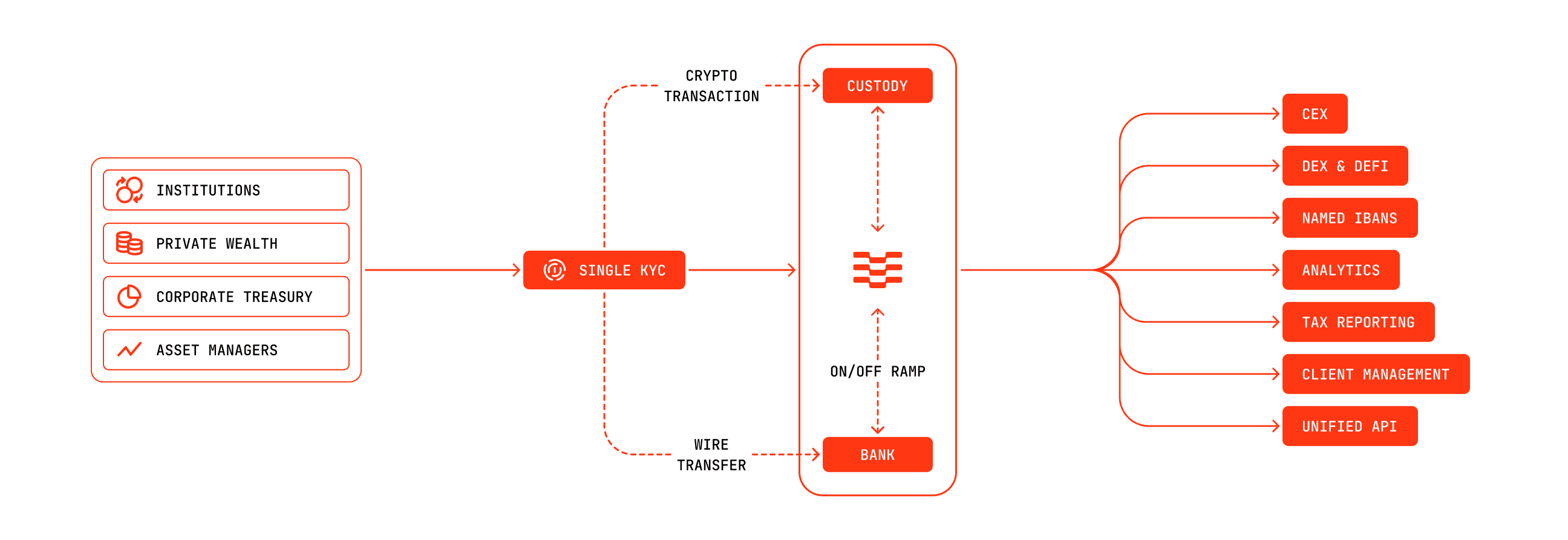

How it Works

How it Works

Family offices face growing demand for crypto exposure, but fragmented platforms, custody risk, and messy reporting make execution hard to control at scale.

Fragmented tools and accounts

One platform for custody, execution, and reporting

High counterparty and operational risk

Segregated accounts + insured institutional custody

Limited access to liquidity and venues

Unified execution across CEX, DEX, and OTC

Hard to delegate safely

Role-based permissions and controlled account access

Messy reporting for finance/tax

Audit-ready statements and exportable records

Slow crypto–fiat conversions

Predictable fiat rails and settlement workflows

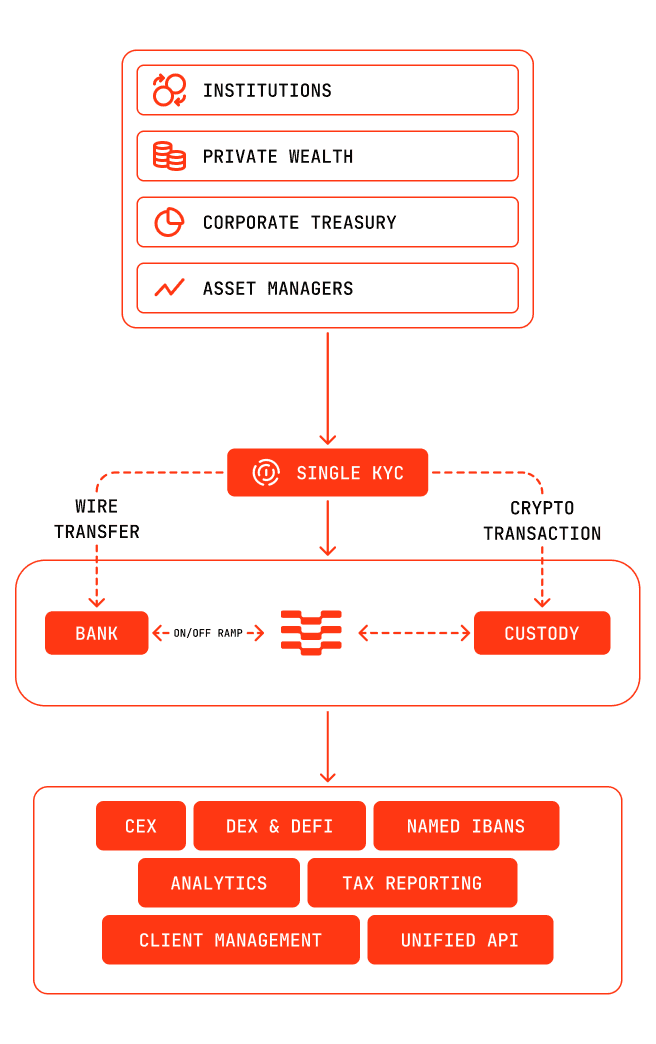

Features

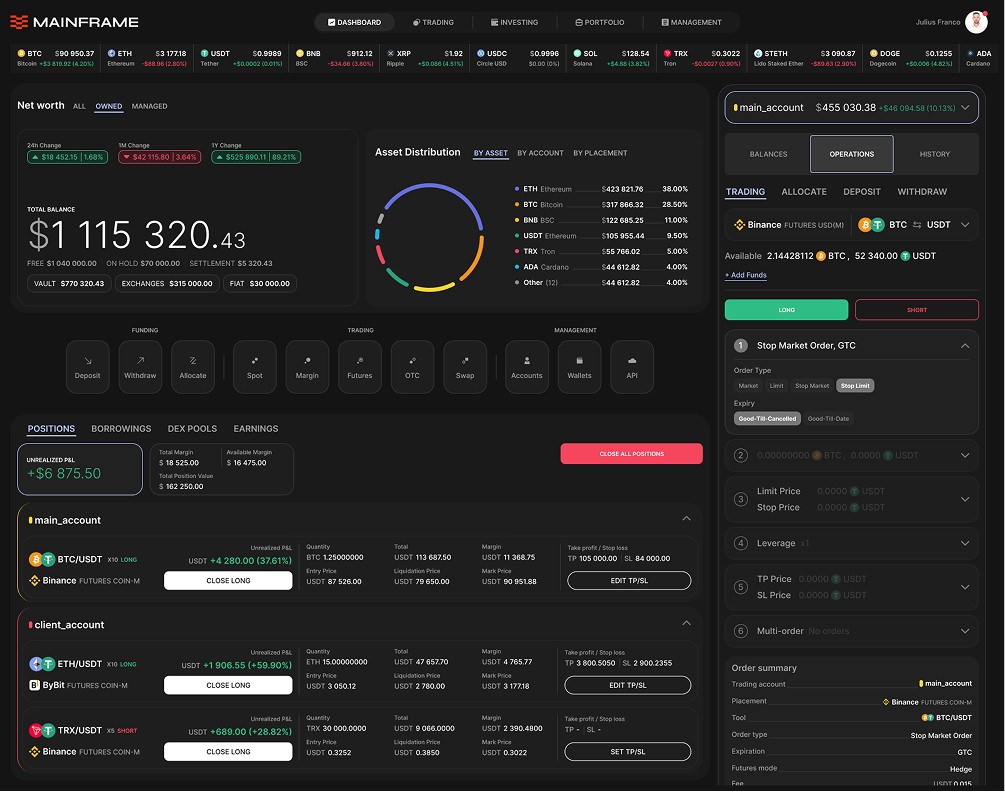

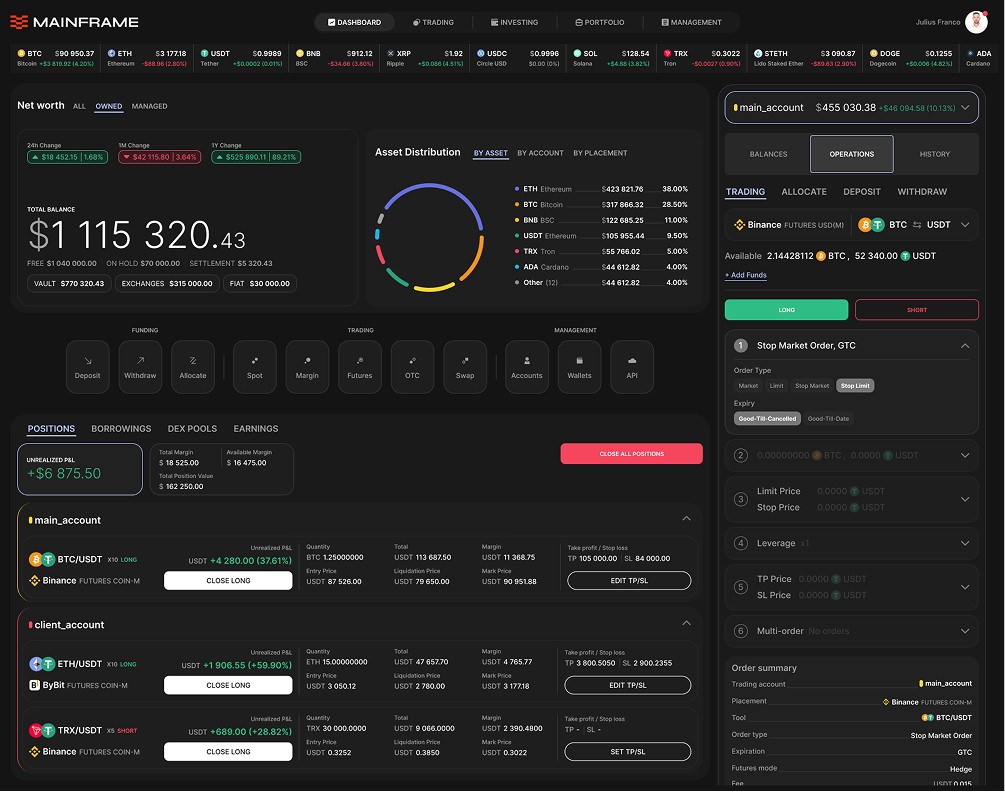

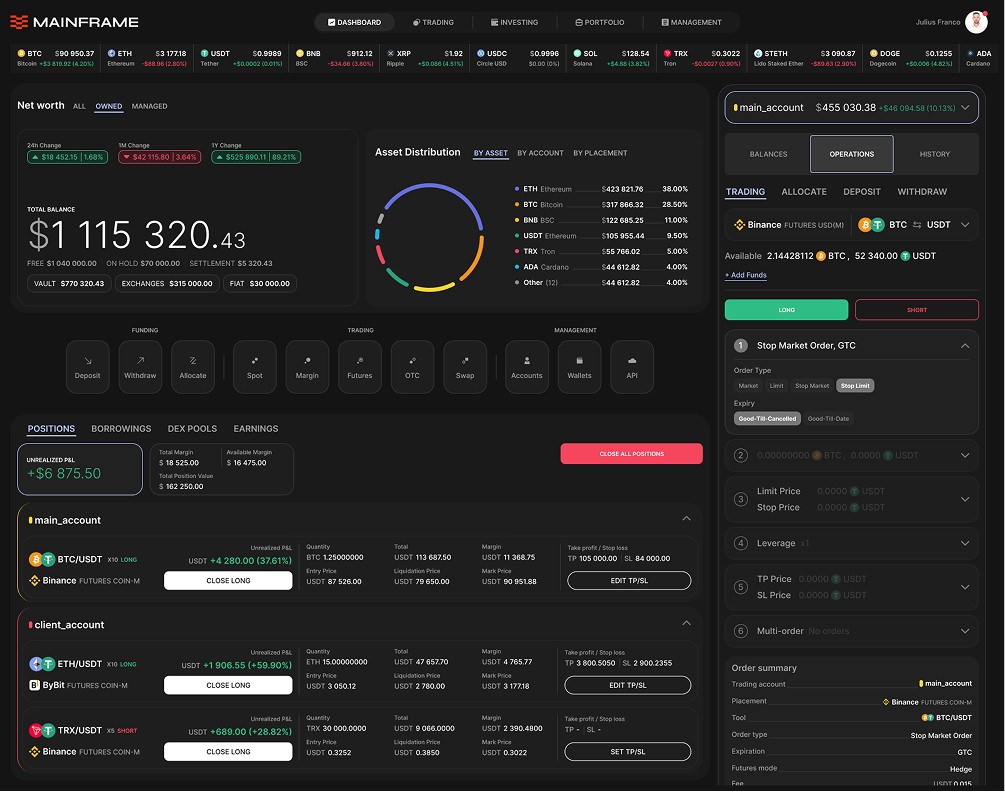

Institutional-grade custody, execution, and reporting — in one unified frame

Features

Institutional-grade custody, execution, and reporting — in one unified frame

Features

Institutional-grade custody, execution, and reporting — in one unified frame

Features

Institutional-grade custody, execution, and reporting — in one unified frame

Portfolio Clarity

Unified view across wallets, venues, and strategies

Cleaner monitoring without fragmented tools

Portfolio Clarity

Unified view across wallets, venues, and strategies

Cleaner monitoring without fragmented tools

Portfolio Clarity

Unified view across wallets, venues, and strategies

Cleaner monitoring without fragmented tools

Capital Protection

Institutional custody with insured storage

Reduced counterparty exposure

Capital Protection

Institutional custody with insured storage

Reduced counterparty exposure

Capital Protection

Institutional custody with insured storage

Reduced counterparty exposure

Multi-Venue Execution

Access CEX, DEX, and OTC from one workflow

Better liquidity reach without multiple onboardings

Multi-Venue Execution

Access CEX, DEX, and OTC from one workflow

Better liquidity reach without multiple onboardings

Multi-Venue Execution

Access CEX, DEX, and OTC from one workflow

Better liquidity reach without multiple onboardings

Fiat Conversion

Predictable crypto–fiat flows via banking rails

Clear funding and withdrawal processes

Fiat Conversion

Predictable crypto–fiat flows via banking rails

Clear funding and withdrawal processes

Fiat Conversion

Predictable crypto–fiat flows via banking rails

Clear funding and withdrawal processes

Audit Reporting

Exportable, audit-ready statements across all activity

Cleaner reconciliation for finance teams

Audit Reporting

Exportable, audit-ready statements across all activity

Cleaner reconciliation for finance teams

Audit Reporting

Exportable, audit-ready statements across all activity

Cleaner reconciliation for finance teams

Team Controls

Role-based access for traders, ops, finance

Approvals and policy limits to reduce risks

Team Controls

Role-based access for traders, ops, finance

Approvals and policy limits to reduce risks

Team Controls

Role-based access for traders, ops, finance

Approvals and policy limits to reduce risks

Ecosystem

Mainframe consolidates your entire workflow into a single, powerful command center.

Ecosystem

Mainframe consolidates your entire workflow into a single, powerful command center.

Ecosystem

Mainframe consolidates your entire workflow into a single, powerful command center.

Pricing Model

Mainframe keeps pricing fully transparent and usage-based — structured through clear setup fees, subscription tiers, and execution commissions.

Onboarding

One time fee

1,000 CHF

Fully guided setup with a dedicated account manager

Client Portfolio

Fee

250 CHF / mo

Per trading account

Bundle

2,500 CHF / mo

Per 10 trading accounts

Execution

Direct CEX trading

250 CHF / mo

Per trading account

Fiat <> crypto swaps

2,500 CHF / mo

Per 10 trading accounts

Aggregated & pre-funded orders

2,500 CHF / mo

Per 10 trading accounts

Pricing Model

Mainframe keeps pricing fully transparent and usage-based — structured through clear setup fees, subscription tiers, and execution commissions.

Onboarding

One time fee

1,000 CHF

Fully guided setup with a dedicated account manager

Client Portfolio

Fee

250 CHF / mo

Per trading account

Bundle

2,500 CHF / mo

Per 10 trading accounts

Execution

Direct CEX trading

250 CHF / mo

Per trading account

Fiat <> crypto swaps

2,500 CHF / mo

Per 10 trading accounts

Aggregated & pre-funded orders

2,500 CHF / mo

Per 10 trading accounts

Pricing Model

Mainframe keeps pricing fully transparent and usage-based — structured through clear setup fees, subscription tiers, and execution commissions.

Onboarding

One time fee

1,000 CHF

Fully guided setup with a dedicated account manager

Client Portfolio

Fee

250 CHF / mo

Per trading account

Bundle

2,500 CHF / mo

Per 10 trading accounts

Execution

Direct CEX trading

250 CHF / mo

Per trading account

Fiat <> crypto swaps

2,500 CHF / mo

Per 10 trading accounts

Aggregated & pre-funded orders

2,500 CHF / mo

Per 10 trading accounts

Start Today

Book a Call

Book a call to see how Mainframe fits your workflow. We’ll walk through onboarding, custody and controls, execution across venues, and reporting — then map the right setup and pricing to your usage.

Start Today

Book a Call

Book a call to see how Mainframe fits your workflow. We’ll walk through onboarding, custody and controls, execution across venues, and reporting — then map the right setup and pricing to your usage.

Start Today

Book a Call

Book a call to see how Mainframe fits your workflow. We’ll walk through onboarding, custody and controls, execution across venues, and reporting — then map the right setup and pricing to your usage.

Your Gateway

to Global Crypto

Markets

Our mission is to institutionalize access to global crypto markets through a single, regulated entry point and one unified KYC — enabling brokers, traders, and institutions to operate with maximum control, efficiency, and compliance.

Your Gateway

to Global Crypto

Markets

Our mission is to institutionalize access to global crypto markets through a single, regulated entry point and one unified KYC — enabling brokers, traders, and institutions to operate with maximum control, efficiency, and compliance.

Your Gateway

to Global Crypto

Markets

Our mission is to institutionalize access to global crypto markets through a single, regulated entry point and one unified KYC — enabling brokers, traders, and institutions to operate with maximum control, efficiency, and compliance.

Your Gateway

to Global Crypto

Markets

Our mission is to institutionalize access to global crypto markets through a single, regulated entry point and one unified KYC — enabling brokers, traders, and institutions to operate with maximum control, efficiency, and compliance.

Mainframe Finance connects top‑tier crypto liquidity, insured custody and multi‑currency fiat banking into a single Swiss‑regulated account, so professional asset managers can scale digital asset strategies without operational chaos.

© 2026 Mainframe Finance AG, Switzerland

Mainframe Finance connects top‑tier crypto liquidity, insured custody and multi‑currency fiat banking into a single Swiss‑regulated account, so professional asset managers can scale digital asset strategies without operational chaos.

© 2026 Mainframe Finance AG, Switzerland

Mainframe Finance connects top‑tier crypto liquidity, insured custody and multi‑currency fiat banking into a single Swiss‑regulated account, so professional asset managers can scale digital asset strategies without operational chaos.

© 2026 Mainframe Finance AG, Switzerland

Mainframe Finance connects top‑tier crypto liquidity, insured custody and multi‑currency fiat banking into a single Swiss‑regulated account, so professional asset managers can scale digital asset strategies without operational chaos.

© 2026 Mainframe Finance AG, Switzerland